Mn Sales Tax Calculator

Sales Tax Rate Calculator | Minnesota Department of Revenue

Sales Tax Rate Calculator. Use this calculator to find the general state and local sales tax rate for any location in Minnesota. The results do not include special local taxes—such as admissions, entertainment, liquor, lodging, and restaurant taxes—that may also apply. For more information, see Local Sales Tax Information .

https://www.revenue.state.mn.us/sales-tax-rate-calculator

Minnesota Sales Tax Calculator - SalesTaxHandbook

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Minnesota has a 6.875% statewide sales tax rate , but also has 274 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 0.521% on ...

https://www.salestaxhandbook.com/minnesota/calculator

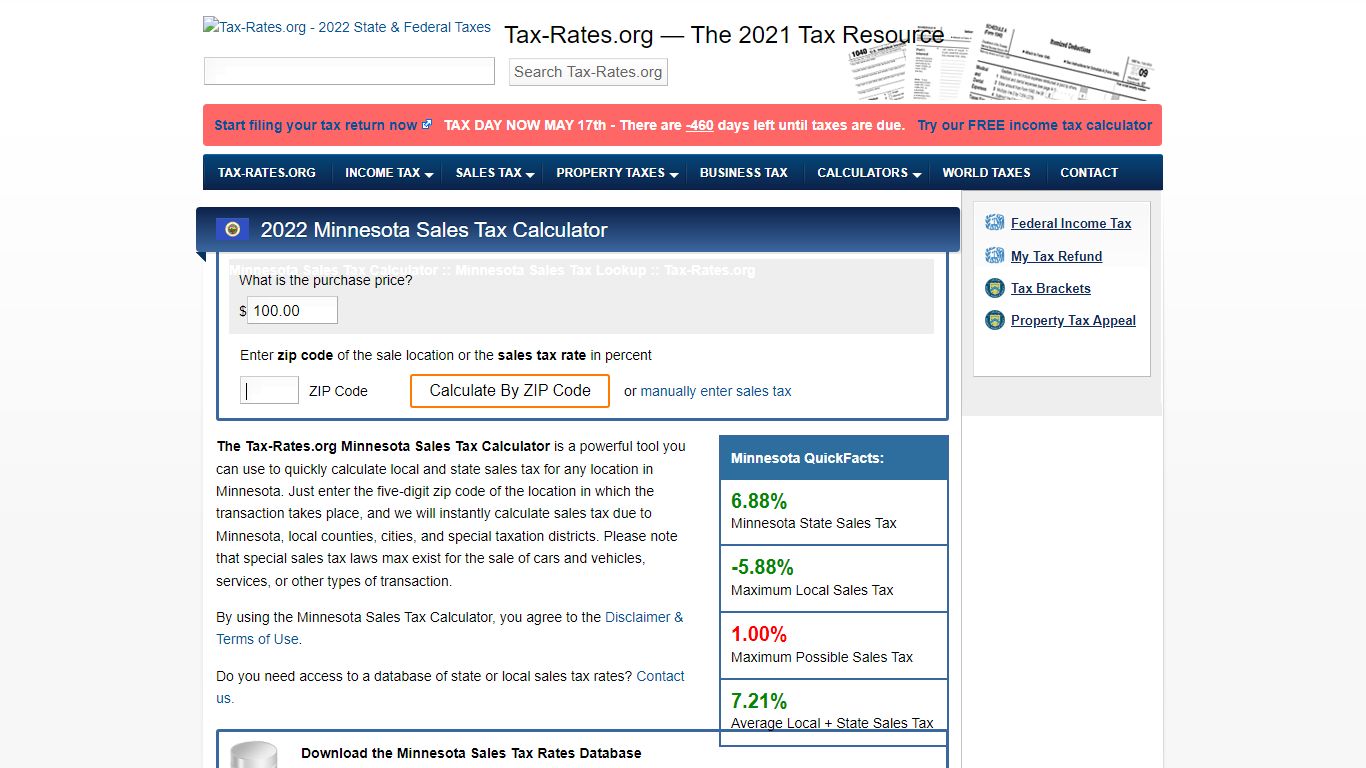

Minnesota Sales Tax Calculator - Tax-Rates.org

Minnesota State Sales Tax. -5.88%. Maximum Local Sales Tax. 1.00%. Maximum Possible Sales Tax. 7.21%. Average Local + State Sales Tax. The Tax-Rates.org Minnesota Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Minnesota. Just enter the five-digit zip code of the location in ...

https://www.tax-rates.org/minnesota/sales-tax-calculator

Sales and Use Tax | Minnesota Department of Revenue

We also administer a number of local sales taxes. Cannabinoid Products and Sales Tax All cannabinoid products that contain CBD or THC are subject to Minnesota sales tax. COVID-19 and Telecommuters From March 13, 2020, to June 30, 2022, Minnesota will not seek to establish nexus for business income tax or sales and use tax solely because an ...

https://www.revenue.state.mn.us/sales-and-use-tax

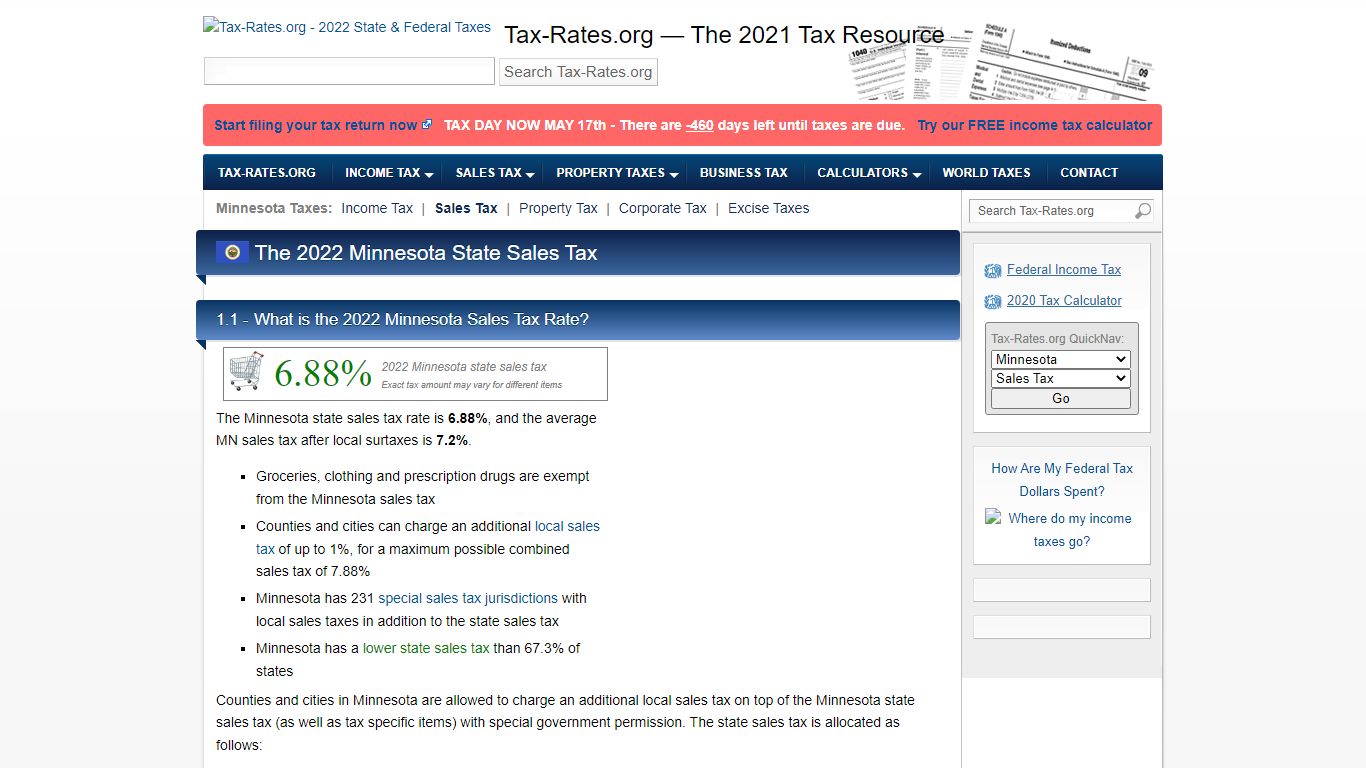

Minnesota Sales Tax Rate - 2022

The Minnesota state sales tax rate is 6.88%, and the average MN sales tax after local surtaxes is 7.2%.. Groceries, clothing and prescription drugs are exempt from the Minnesota sales tax; Counties and cities can charge an additional local sales tax of up to 1%, for a maximum possible combined sales tax of 7.88%; Minnesota has 231 special sales tax jurisdictions with local sales taxes in ...

https://www.tax-rates.org/minnesota/sales-tax

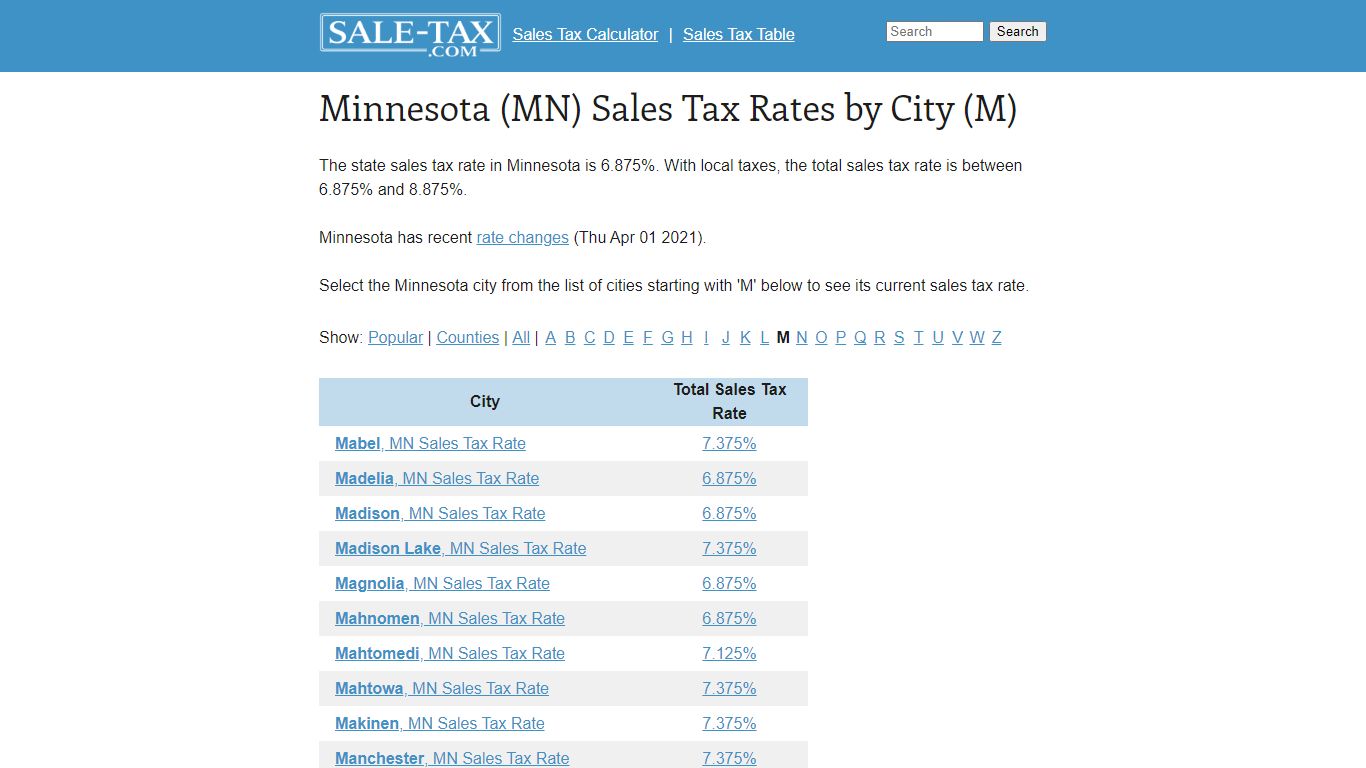

Minnesota (MN) Sales Tax Rates by City (M) - Sale-tax.com

The latest sales tax rates for cities starting with 'M' in Minnesota (MN) state. Rates include state, county, and city taxes. 2020 rates included for use while preparing your income tax deduction. ... Sales Tax Calculator | Sales Tax Table. Follow @SaleTaxCom. Sales tax data for Minnesota was collected from here. Sale-Tax.com strives to have ...

https://www.sale-tax.com/Minnesota_M

Sales Tax Calculator

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Usually, the vendor collects the sales tax from the consumer as the consumer makes a purchase. In most countries, the sales tax is called value-added tax (VAT) or goods and services tax (GST), which is a different form of consumption tax.

https://www.calculator.net/sales-tax-calculator.html

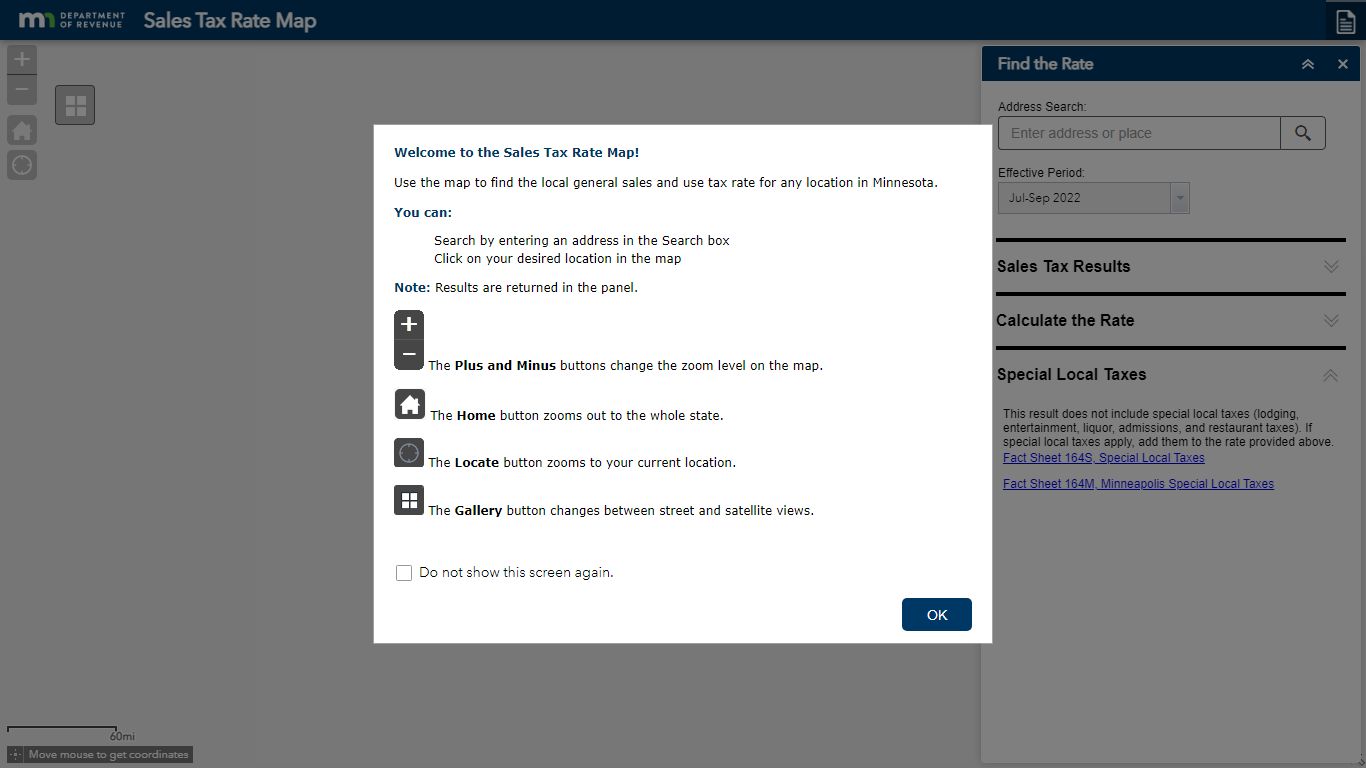

ArcGIS Web Application

Your browser is currently not supported. Please note that creating presentations is not supported in Internet Explorer versions 6, 7. We recommend upgrading to the ...

https://taxmaps.state.mn.us/salestax/

DVS Home - Motor Vehicle Sales Tax - Minnesota

Sales Tax Guideline for Older Cars. Instead of the 6.5% Motor Vehicle sales tax, a $10 In-Lieu of Tax applies if the vehicle meets all of the following: The vehicle is 10 years or older, and. It has a sales price and average value of less than $3,000. If the vehicle does not meet both requirements it does not qualify for the $10 flat in-lieu of ...

https://dps.mn.gov/divisions/dvs/Pages/Motor-Vehicle-Sales-Tax.aspx

Minnesota Income Tax Calculator - SmartAsset

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. ... Minnesota Sales Tax. The ...

https://smartasset.com/taxes/minnesota-tax-calculator